How to Become a Tax Filer in Pakistan (2022)

Mavens & Co will guide you through the process of tax filing in Pakistan. To simply put, A tax filer is a person who pays taxes to the government of Pakistan, which gives them certain perks for which a non-filer is not. Mavens pride itself on providing some of the leading and very best experienced professionals to help you with your legal proceedings, whether you are an individual or a business owner.

What is Income Tax?

It is a type of tax imposed on individuals or businesses. These taxes are sources of revenue for the government, which the government can use to fund projects.

Why Should you File Tax?

- A filer has to pay half the withholding tax (WHT) compared to a non-filer.

- People who file taxes can own property of any worth.

- Non-filers are not allowed to own property worth more than 50 LAC.

- When it comes to selling or buying property, a filer has to pay lower tax rates.

- A filer can claim overpaid tax.

- When it comes to government-based auctioning, non-filer pays 15%, whereas filer pays 10%.

- It is one of the best ways to identify yourself as a dutiful citizen.

There are numerous benefits if you are a regular tax filer. For more information, you can consult us, Mavens & Co. Our expert legal consultant will guide you thoroughly.

Who is Required to File Tax?

Any salaried individual with an income greater than 500,000 PKR must file taxes. For further details, you can visit the official link of FBR for tax obligations. At Mavens & Co, we have simplified income tax filing for individuals and corporations.

How to Know if you are Already a Filer or not?

An active taxpayer list (ATL) is a central record for income tax return filers. To find your ATL status, FBR has introduced mobile SMS service. You need to type “ATL (space) 13 digits CNIC number” and send it to 9966.

You can also visit FBR’s online portal to check whether you are an active taxpayer or not. Visit this link and enter values in the required fields.

What is NTN (National Tax Number), and How to Get it?

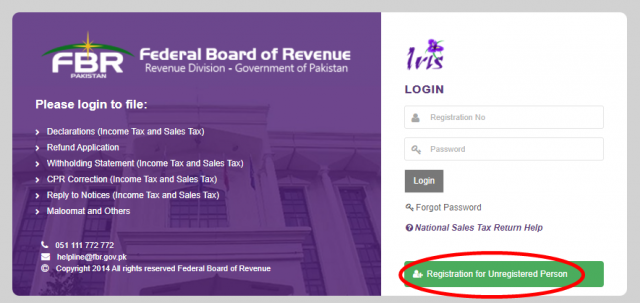

Since you have the idea of whether you are eligible to become a filer or not, let’s discuss the very first step of your Tax Filing journey. The very first thing that is needed from you as an individual to become a tax filer is that you will need an NTN (National Tax Number). An NTN is an ID issued by FBR to file taxes. You can have one by going to the FBR IRIS website. Get yourself registered by clicking the “Registration for Unregistered Person” button and fill the required fields.

For thorough details of each step involved, visit our article on How to get NTN. In the case of an individual, 13-digit CNIC is the NTN.

Fortunately, at Mavens & Co., we opt for what’s best for our clients; we can assist with all the relevant documentation regarding tax filing.

E-Enrollment for Tax Filing

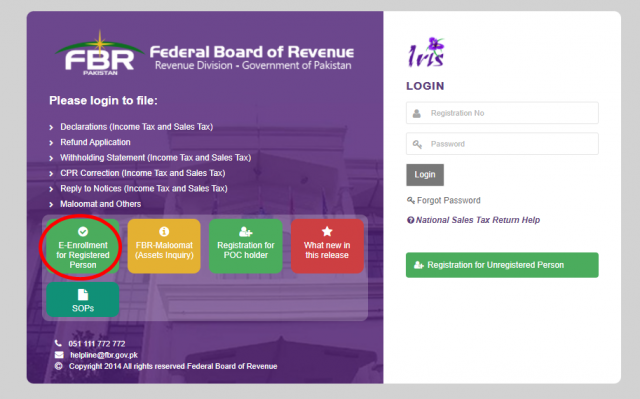

Once you have your NTN, you can click on “E-enrollment for registered person” under “Maloomat and Others” and fill in the required fields. You have to file an income tax return and wealth statement if you are a salaried individual.

Once you Login to IRIS, you Can File a Return of Income as Follows:

- Select “Declaration” on the Horizontal Bar Menu present at the top of the interface. A Vertical Drop-Down menu will appear.

- “114(1) (Return of Income filed voluntarily for complete year) “should be selected. An Interface will appear.

- Click on the “Period” Button on the right part of the screen. A Dialog box will appear.

- In the “Tax Period” field, enter the correct year.

- Click on “search” then click on “Select” against the relevant dates which appear in the Box.

- Select suitable choices from the left-hand Vertical Menu and begin entering data.

Once you Login to IRIS, you Can File a Wealth Statement as Follows:

- Select “Declaration” on the Horizontal Bar Menu present at the top of the interface. A Vertical Drop-Down menu will appear.

- “116(2) (Statement of Assets / Liabilities filed voluntarily) “should be selected. An Interface will appear.

- Click on the “Period” Button on the right part of the screen. A Dialog box will appear.

- In the “Tax Period” field, enter the correct year.

- Click on “search” then click on “select” against the relevant dates which appear in the Box.

- Click on “Personal Assets / Liabilities / Receipts / Expenses”

- Again, click on the “Personal Assets / Liabilities” Tab

- A Grid will open. Enter data in relevant Fields

Conclusion

Tax filing is indeed a rigorous and time-consuming task. But with this arduous task comes the benefits of being a regular tax filer. Do you want to save yourself from all these hassles? You can contact us, Mavens & Co., and we will take care of your tax filing.